International real estate investment has become a lucrative opportunity for individuals seeking financial growth and diversification. With global markets offering various advantages, investing in properties abroad can yield high returns. However, stepping into this domain requires strategic planning, extensive research, and knowledge of legal, financial, and market dynamics.

Understanding International Real Estate Investment

An international real estate investor purchases properties in foreign countries for rental income, capital appreciation, or commercial purposes. This investment strategy allows diversification beyond local markets and provides exposure to different economic conditions and currencies.

Steps to Become an International Real Estate Investor

1. Define Your Investment Goals

Before entering the global real estate market, you must outline your objectives. Are you looking for rental income, long-term appreciation, or commercial investments? Having a clear strategy helps in making informed decisions.

2. Research Potential Markets

Thorough research is essential when choosing a country or city to invest in. Consider factors such as:

- Economic stability

- Legal and regulatory environment

- Property appreciation rates

- Rental yields

- Tax implications

For example, MM Towers in Dubai is a well-known property investment opportunity due to its high rental yields and modern infrastructure. Similarly, cities with strong tourism, business hubs, and expatriate communities offer promising investment prospects.

3. Understand the Legal Framework

Each country has different legal requirements for foreign investors. Some allow direct purchases, while others may require partnerships with local entities. Research property ownership laws, visa regulations, and residency permits that come with property investment.

4. Assess Financial Aspects

Consider the following financial factors:

- Property prices

- Mortgage options for foreign investors

- Currency exchange rates

- Taxation policies

- Additional costs (maintenance, legal fees, property management)

It’s advisable to consult with financial advisors who specialize in international real estate investments.

5. Choose the Right Property

Once you have shortlisted potential markets, focus on selecting the right property type:

- Residential properties: Apartments, villas, townhouses

- Commercial properties: Offices, retail spaces, warehouses

- Vacation rentals: Ideal in tourist-friendly locations

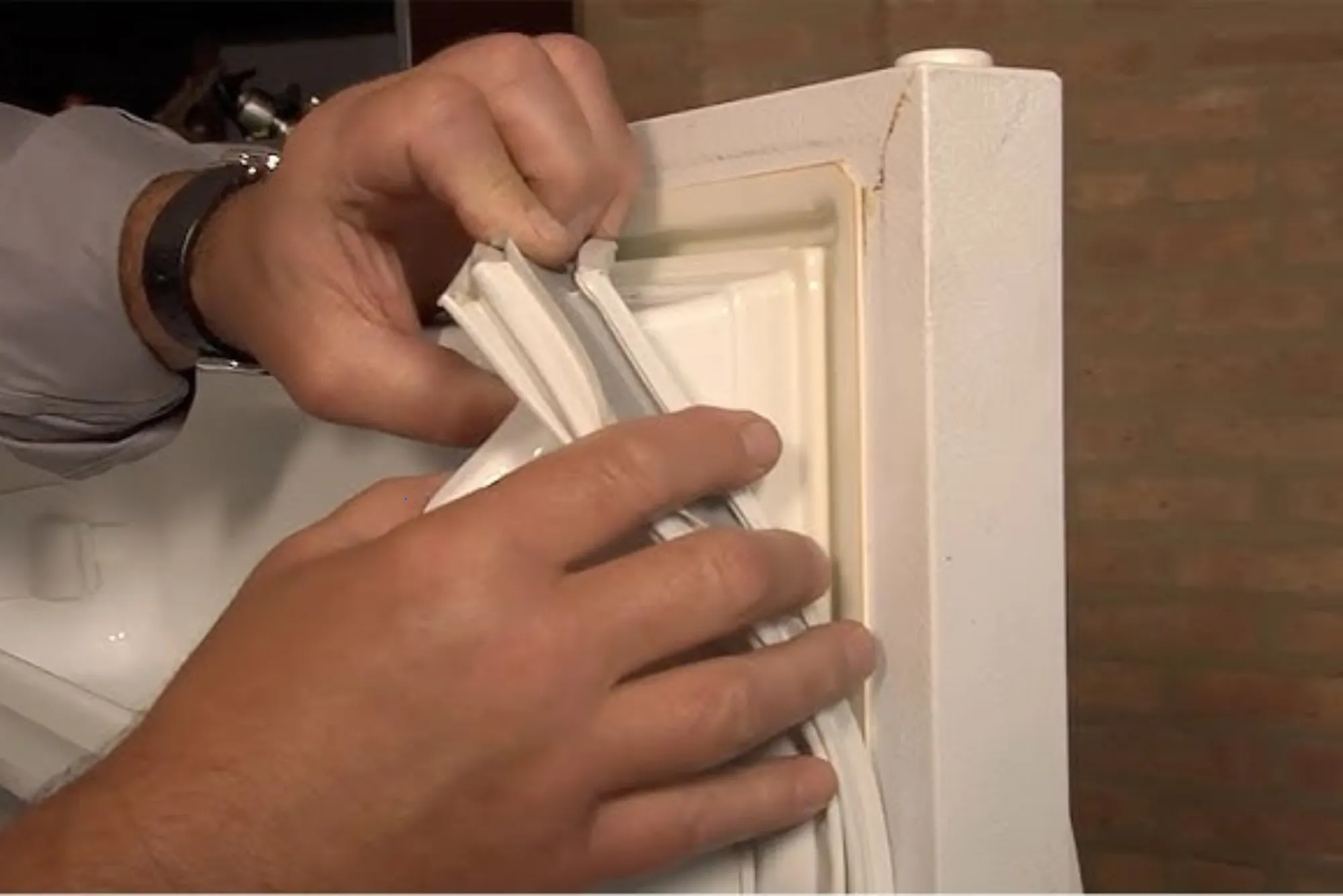

Conduct physical or virtual property inspections to ensure quality and legitimacy before making a purchase.

6. Secure Financing

Many banks and financial institutions offer loans to foreign investors, but interest rates and conditions vary. Some financing options include:

- Home country banks with international branches

- Foreign banks in the target country

- Developer financing options

If you are investing in regions like the UAE, ensure your financial history is clear, including any pending issues like Sharjah traffic fines check, as unpaid fines could affect loan approvals.

7. Hire Local Experts

Working with local professionals helps streamline the investment process. Essential experts include:

- Real estate agents: Provide market insights and property listings

- Legal advisors: Handle contracts, ownership rights, and local laws

- Tax consultants: Ensure compliance with tax obligations

- Property managers: Maintain and manage rental properties remotely

8. Consider Tax Implications

Taxation laws vary by country, so it’s crucial to understand:

- Capital gains tax

- Property tax

- Rental income tax

- Double taxation agreements between your home country and the investment location

9. Plan for Property Management

Managing properties internationally requires efficient communication and management strategies. You can opt for:

- Self-management (if residing nearby)

- Hiring property management companies for maintenance, tenant handling, and rent collection

10. Monitor Market Trends

Regularly tracking market trends, property value fluctuations, and local economic changes helps you make timely decisions. Stay updated on:

- Real estate market reports

- Policy changes affecting foreign investors

- New investment opportunities

Risks and Challenges of International Real Estate Investment

Investing in international real estate presents some challenges, including:

- Currency fluctuations: Impact overall returns

- Legal complexities: Varying regulations can pose obstacles

- Market volatility: Economic downturns affect property value

- Cultural differences: Navigating language and business practices

Mitigate risks by diversifying investments and conducting thorough due diligence before purchasing properties.

Becoming an international real estate investor requires careful planning, market research, and collaboration with professionals. Identifying the right locations, such as MM Towers, and ensuring compliance with financial regulations, like checking your Sharjah traffic fines check, can contribute to a smooth investment journey. With a strategic approach, global property investment can offer lucrative opportunities for long-term wealth creation.